I’m pulling together important resources and the most up-to-date information here to make sure you have everything you need to get financial support and understand how to navigate your finances after school. If you have trouble with any of these resources or navigating your federal student aid, contact my office at (984) 275-6150.

Recent News:

-

The Biden Administration has announced a three-part plan to help 153,000 working and middle-class federal student loan borrowers transition back to regular payment as pandemic-related support expires. This plan includes loan forgiveness of up to $20,000 for many people. Click here to see if you qualify and for more info.

-

The Department of Education has launched a series of webinars to help students and their families better understand changes to the FAFSA and general questions about federal financial aid. Learn more and find the next dates by clicking here.

-

There have been updates to income-determined payment plans for your loans. To apply for an Income-Driven Repayment Plan or to learn more about the new Saving on a Valuable Education (SAVE) plan, click here.

-

Check out Pro Tips for the 2024-25 FAFSA Form by clicking here.

-

For any issues with the new FAFSA Form in 2024-25, you can click here for updates and resolutions.

What I'm Doing for Students and Borrowers in Congress

GETTING ANSWERS ON LOAN REPAYMENTS:

I sent a letter with my colleagues on the Future Forum Caucus to the Department of Education following the announcement that interest and student loan repayments would both resume in fall of 2023. We asked the Department of Education a host of questions to ensure our federal student loan borrowers had an easier transition to resuming payments. We got a response from the Department of Education in February, 2024 which you can access by clicking here.

ADDRESSING A FAFSA GLITCH:

A new version of the federal student aid application known as the FAFSA is now available to all college applicants for the 2024-2025 school year. Following the rollout I, alongside my colleagues, sent a letter to the Department of Education highlighting my concerns with a “glitch” in the new FAFSA that impacts our immigrant community.

All U.S. citizen students are eligible for federal financial aid, regardless of their parents' immigration status. If a student is a citizen, but their parents are legal permanent residents or undocumented, the student is still required to submit both the student and parent portions of the application. However, the new system is returning an error message when parents who do not have SSNs try to submit their portion of the application. Following our letter alerting them to the glitch, the Department of Education announced a workaround to the issue, which you can learn more about by clicking here.

UPDATE: As of March 12th, 2024, the Department of Education announced that they have addressed this technical issue and parents without an SSN may now start the form for a student.

Resources for Current/Prospective Students

The Basics: Getting Started

-

Free information is readily available from:

-

High school counselors

-

College and career school financial aid offices (where you plan to attend)

-

Local and college libraries

-

Federal Student Aid(U.S. Department of Education)

-

Keep copies of all forms and correspondence: you must reapply for aid each year.

-

Parents of students: check out these savings plans and tips for affording college

-

Beware of scholarship scams -- don't pay for free information!

Know Your Deadlines

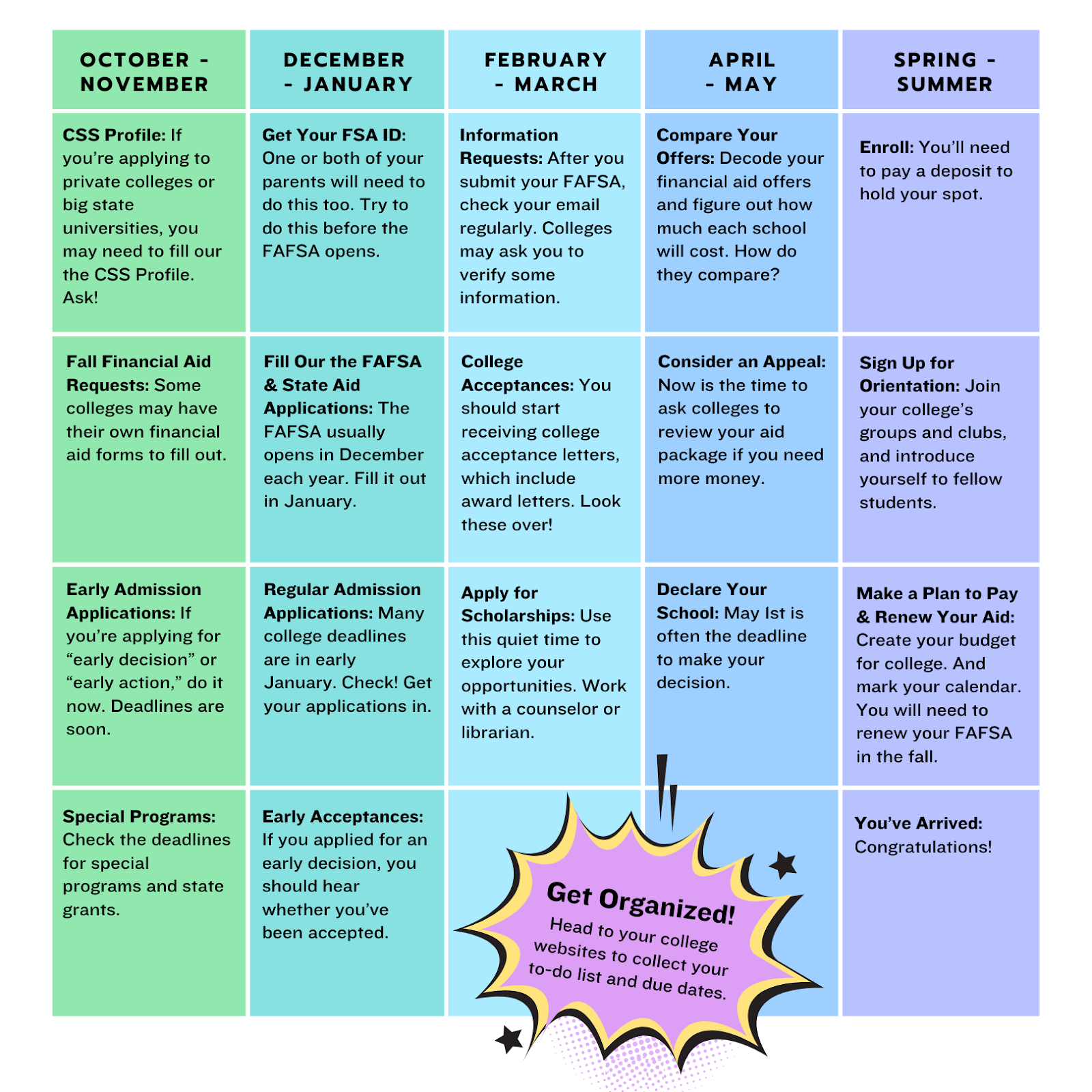

Ready for your college journey? Let's look at what will happen in your senior year. Note: This timeline is designed for students heading to college in the fall, but you may be on a different schedule. Check with your schools and any special programs you're applying to. Deadlines will vary.

Student Aid and Where It Comes From

The first mistake many students and families make is assuming they can't afford college. Don't be discouraged by the sticker price of college until you know how much financial aid may be available to you. Financial aid can significantly reduce the cost of college, but it can be tricky to estimate how much student aid you will get. Two factors are generally used to determine who gets student aid and how much they get: need and merit.

-

"Merit-based" aid is given to students who do something exceptionally well (like music, athletics, or academics) or to students who plan to have a career in an area that will benefit the community or the country (like teaching, science, math, and engineering).

-

"Need-based" aid is given to students who demonstrate a lack of financial resources to pay for college.

Some student aid programs use a combination of need and merit to determine eligibility.

It all starts with the Free Application for Federal Student Aid (FAFSA). With this one application, you can apply for financial aid at multiple colleges and from multiple funding sources (federal, state, institutional and private providers of assistance).

Federal Student Aid

-

Provides nearly 70% of student aid under Loans, Grants and Federal Work-Study Programs.

-

Available to all need-based applicants; some loans and competitive scholarships for non need-based.

-

Free information from the United States Department of Education:

-

Loans are the most common federal aid and must be repaid when you graduate or leave college.

-

Scholarships/grants are mostly need-based and require no repayment:

-

Work-Study Programs allow you to earn money while in school:

-

It provides part-time employment while you are enrolled in school.

-

It's available to undergraduate, graduate, and professional students with financial need.

-

It's available to full-time or part-time students.

-

It's administered by schools participating in the Federal Work-Study Program. Check with your school's financial aid office to find out if your school participates.

-

For questions not covered by the Department of Education website, call the Federal Student Aid Information Center at 1-800-433-3243.

States offer residents a variety of scholarships, loans, and tuition exemptions.

Colleges and universities provide some 20% of aid, most need-based. Check specific university websites and the institution's financial aid office when you apply for admission.

What Is the FAFSA?

Do you need financial assistance to go to college? If you want help from the federal government, you'll need to fill out an online form called the Free Application for Federal Student Aid, better known as the FAFSA.

Your state government and individual colleges may also use the FAFSA to award financial aid. There is lots of money available, more than most students think. The FAFSA takes you step by step through the questions you'll need to answer. It was recently redesigned to be simpler and faster.

The Department of Education rolled out a new FAFSA application on December 30th, 2023. The new FAFSA or the 2024-2025 FAFSA has several key changes but the overarching goal will be to streamline the process for families seeking federal financial aid. If you have issues with the new FAFSA form, please contact the Department of Educations' Ombudsman.

Here are some helpful resources as you complete the 2024-2025 FAFSA.

How Does the FAFSA Work?

The FAFSA asks questions about your family and collects information about what you and your parents earn. Why does the FAFSA need this information?

The federal government aims to give money to students who need it most. Many colleges also use information on the FAFSA to estimate your family's ability to pay for college and how much aid they may need to offer you.

Is the FAFSA for You?

Almost certainly! Filling out the FAFSA opens the door to almost all financial aid — including help from the federal government, state government, the colleges' own funds, and many private scholarships. If you are an undocumented student and or student who has received Deferred Action for Childhood Arrivals (DACA), you can't receive federal aid and you won't fill out the FAFSA, but there are funds available from many other sources (state aid, college or career/trade school financial aid, or private scholarships).

Helpful FAFSA resources:

-

Check out Pro Tips for the 2024-25 FAFSA Form by click here

-

The Department of Education has launched a series of webinars to help students and their families better understand changes to the FAFSA and general questions about federal financial aid. Learn more and find the next dates by click here

-

For any issues with the new FAFSA Form in 2024-25, you can click here for updates and resolutions.

-

You can also reference this helpful resource for assistance with your 2024-2025 FAFSA.

Resources for Former Students/Borrowers

After college, the federal government has ways to help you repay your loans. Eligibility depends upon the type of loan, when it was made, and whether it's in default.

In March 2020, a COVID-19 pandemic-related pause for many federal student loan borrowers was implemented for payments, interest, and collections. The U.S. Department of Education's relief for student loans has now ended. The 0% interest rate ended Sept. 1, 2023, and payments restarted in October of 2023.

Repaying your student loans can be confusing and as many payments have been paused for three years, I want to help ensure a smooth transition for borrowers in our district.

Loan Repayment Plans:

-

Borrowers can pick a repayment plan based on their monthly payment on their income or that gives them a fixed monthly payment. The types of repayment plans include:

-

Repayment plans based on your income are a strong choice to lower your monthly payments. For example, the newest income-driven repayment plan, the Saving on a Valuable Education (SAVE) Plan, offers payments which are no more than 10% of your discretionary income.

-

The Fresh Start Program is a one-time, temporary program that offers borrowers a path out of default and restores their access to federal student aid. Borrowers who access this program will be able to end collections on defaulted loans, remove default from credit reports, and enroll in a repayment plan, including IDR plans.

-

If you don't pick a repayment plan, your loan servicer will place you on the Standard Repayment Plan (a 10-year fixed payment repayment plan). This plan might result in a higher monthly payment for you.

-

You can compare repayment plans here through the Department of Education Loan Simulator to find out which plans you're eligible for.

Preparing for Repayment

-

Borrowers should make sure that they have an active and updated StudentAid.gov account and updated contact information on their loan servicer's website.

-

Borrowers can reference StudentAid.gov to see what kinds of federal student loans they have, how much they owe, and what the status of their loan is. This will be available on your StudentAid.gov Dashboard.

-

Borrowers can also call 1-800-4-FED-AID (1-800-433-3243) for information about who their loan servicer is or they can find this information here.

-

Borrowers should check to see if they are eligible to have some or all of their loans canceled.

-

Review important concepts, tips, and recommendations for repaying your student loans at Repaying Student Loans 101.

Applying For Income-Driven Repayment Plans:

-

Borrowers can apply for an Income-Driven Repayment (IDR) plan by clicking here.

-

To see a customizable walk-through of the application process for IDR, click here.

-

As borrowers enroll in an IDR plan, you'll have the option to grant the Department secure access to your IRS tax information to make the application process faster and easier.

-

Borrowers can expect enrollment to take several weeks for their application to be processed. Borrowers can send in a paper application if needed.

Other Questions

For more information about managing your student loans and potential relief options, see the Department of Education's website for borrowers, studentaid.gov.

Other Resources

Interested in public service?

Federal assistance programs seek to encourage people to work in geographic areas or professions where there's a particular need (such as doctors in underserved areas); encourage underrepresented groups to enter a particular profession; and provide aid in exchange for services provided (such as military service).

-

AmeriCorps Education Award

Volunteers who complete one year of service receive an education award for current higher education expenses or to repay student loans.

-

Army Tuition Assistance

Additional benefits for Army personnel.

-

Indian Health Service

Scholarships for American Indian/Alaskan Native health profession students and loan repayment for persons working in IHS facilities.

-

Military academies:

-

National Health Service Corps

Scholarships and loan repayment for health profession students who agree to work in underserved areas.

-

Nursing Scholarships

Offered in exchange for two years of service in areas with critical nursing shortages.

-

Reserve Officers Training Corps (ROTC)

For students who want to be commissioned as officers after graduating from college.

-

USA Jobs: Welcome Students and Recent Graduates

Scholarships, grants, fellowships, internships, and cooperative education with federal agencies.