Press Releases

Congressman Nickel Introduces the Keep Housing Affordable Act

Cary, NC,

July 2, 2024

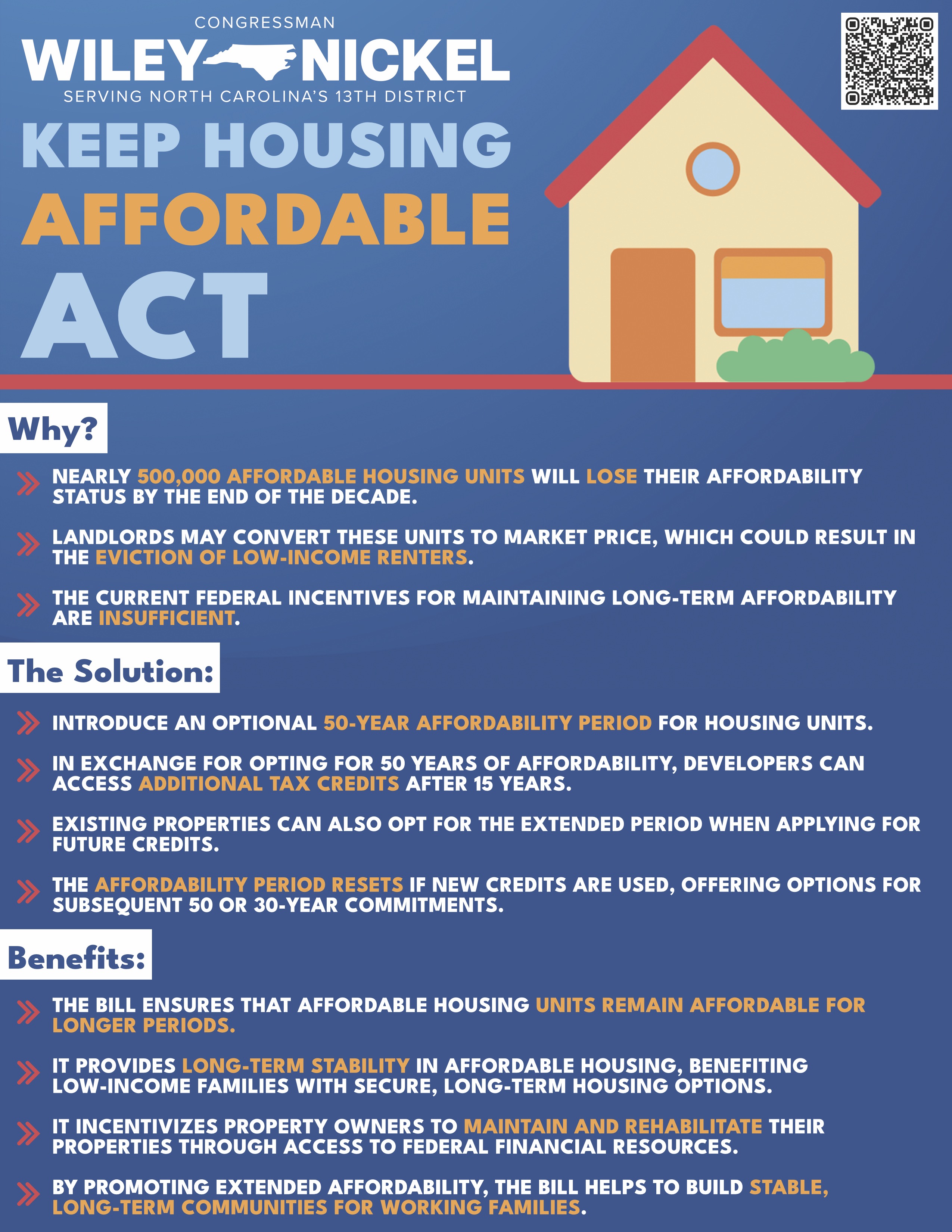

Today, Congressman Wiley Nickel (NC-13) introduced the Keep Housing Affordable Act to bolster the Low Income Housing Tax Credit (LIHTC) Program and incentivize developers to maintain the affordability of housing units for extended periods. “We’re in the middle of a housing crisis in North Carolina. The Keep Housing Affordable Act is a crucial solution that incentivizes developers to maintain the affordability of homes for a long time to come,” said Congressman Wiley Nickel. “Doing so will help boost the affordable housing supply, enhance home quality, and create long-term stability for working families across North Carolina’s 13th District.” According to the National Low Income Housing Coalition, there are only 66 affordable and available rental units per 100 households at or below the 50% Area Median Income threshold in North Carolina. Statewide, that means that there are 185,186 fewer affordable homes available than are needed to affordably house working families. The Low Income Housing Tax Credit (LIHTC) Program awards developers federal tax credits to offset construction costs in exchange for reserving a set number of units in their properties as affordable housing for thirty years. Unfortunately, according to the National Low Income Housing Coalition, nearly 500,000 LIHTC-financed units, representing almost a quarter of all such units in place, will reach the end of their 30-year affordability period by the end of this decade. This leaves landlords to convert their affordable units and charge market rents, exacerbating the affordable housing crisis and potentially subjecting hundreds of thousands of low-income renters to eviction if they cannot pay market rents. The Keep Housing Affordable Act would seek to remedy this problem by establishing an optional 50-year affordability period. Under this proposal, a sponsor could elect at the time of application for credits to maintain affordability for 50 years. In return, the sponsor could access credits after 15 years without reducing the Private Activity Bonds (PAB) volume cap. This future cap-free access to credits would encourage developers to opt into 50 years of affordability by assuring them of resources for recapitalization that might otherwise not be available. The affordability period would reset if the sponsor uses PABs after 15 years. At that time, sponsors could either commit to 50 years of subsequent affordability, again with access to credits 15 years after that or commit to 30 years of subsequent affordability without access to more credits without superseding the previous 50-year affordability commitment. Full text of the Keep Housing Affordable Act can be found HERE.

|